The Lok Sabha election 2024 is not just another political event; it is a goldmine of opportunities for savvy traders. Think about transforming political drama into monetary success. This election could be your ticket to unprecedented market gains.

This election is important, and as a trader, the only thing that matters is how you plan to take advantage of the opportunity.

Brace Yourself for the Lok Sabha Election 2024 Result

As the election date (4 June 2024) draws nearer, market volatility is expected to spike more, creating fertile ground for strategic trading. Here’s how to get ready to take advantage of this once-in-a-lifetime chance and make sure you don’t miss out on possible earnings.

1. Market Volatility: The Trader’s Playground

Elections bring volatility, and volatility means opportunity. The Indian stock market is expected to experience significant price swings as the nation heads to the polls. This is where traders thrive.

- High Volatility: Rapid and unpredictable price changes create perfect conditions for trading.

- Price Swings: Quick reactions can lead to substantial profits from short-term movements.

2. Policy Shifts: New Rules, New Opportunities

The election outcome will dictate economic policies. A clear mandate can lead to the continuation or introduction of pro-business policies, setting the stage for a market rally.

- Economic Reforms: Anticipate bold moves in sectors like infrastructure, banking, railways, energy, and defense.

- Regulatory Changes: Changes in tax policies and government spending can directly impact stock prices.

3. Investor Sentiment: Riding the Wave

Elections influence investor sentiment significantly. A strong government mandate usually boosts confidence, while a fragmented verdict can cause market panic.

- Market Sentiment: Stable governance generally leads to market rallies.

- Foreign Investment: Political stability attracts foreign investors, driving up stock prices.

How to Capitalize on the Opportunity

The Lok Sabha 2024 election presents a unique opportunity for traders to capitalize on market volatility and potential price swings. To capitalize on this opportunity, traders should understand market dynamics, prepare for volatility, leverage technical analysis, focus on sector-specific strategies, manage risk, and stay informed.

Analyzing past trends and the political impact on various industries can help spot patterns and guide trading strategies.

Read also: 10 Golden Rules of Trading Options: Dos and Don’ts

How to Make a Winning Trading Plan

Futures contracts can stabilize prices and function as a buffer against changes in the market, while options trading can be utilized to reduce risk and increase possible returns.

Sharp price swings might provide opportunities for rapid earnings in intraday and swing trading.

Traders should stay updated on real-time news and market reactions. To adapt their strategies to political outcomes, they must also be flexible.

Prepare for Multiple Scenarios

Develop trading strategies for different election outcomes. Remain adaptable and prepared to modify your tactics in response to election results.

- Scenario Planning: Make your plans specific to situations such as a huge NDA majority, a close victory, or a victory by the opposition.

- Flexibility: Be prepared to pivot your approach based on real-time news.

Focus on Key Sectors

Identify sectors that could benefit the most from election outcomes and focus your trading there.

- Infrastructure: Government spending on infrastructure could surge post-election.

- Banking: Pro-reform government policies can boost banking stocks.

- Defense: Increased defense spending benefits companies in this sector.

Use Options for Leverage

Options can amplify your gains, whether the market goes up or down.

- Call Options: In bullish scenarios, use call options to maximize gains.

- Put Options: Hedge against potential downturns with put options.

Stay Informed and React Quickly

Watch for updates in real-time and be prepared to take action when the market shifts.

- Real-Time News: Monitor election news and market reactions.

- Technical Analysis: Use live charts to identify the best entry and exit points.

Diversify and Manage Risk

Spread your trading to mitigate risks and protect your capital.

- Portfolio Diversification: Trade across different entities like cash, futures, and options to diversify your trades.

- Risk Management: Use stop-loss orders and focus on proper position sizing to manage risk.

The Scenarios: How the Market Might React

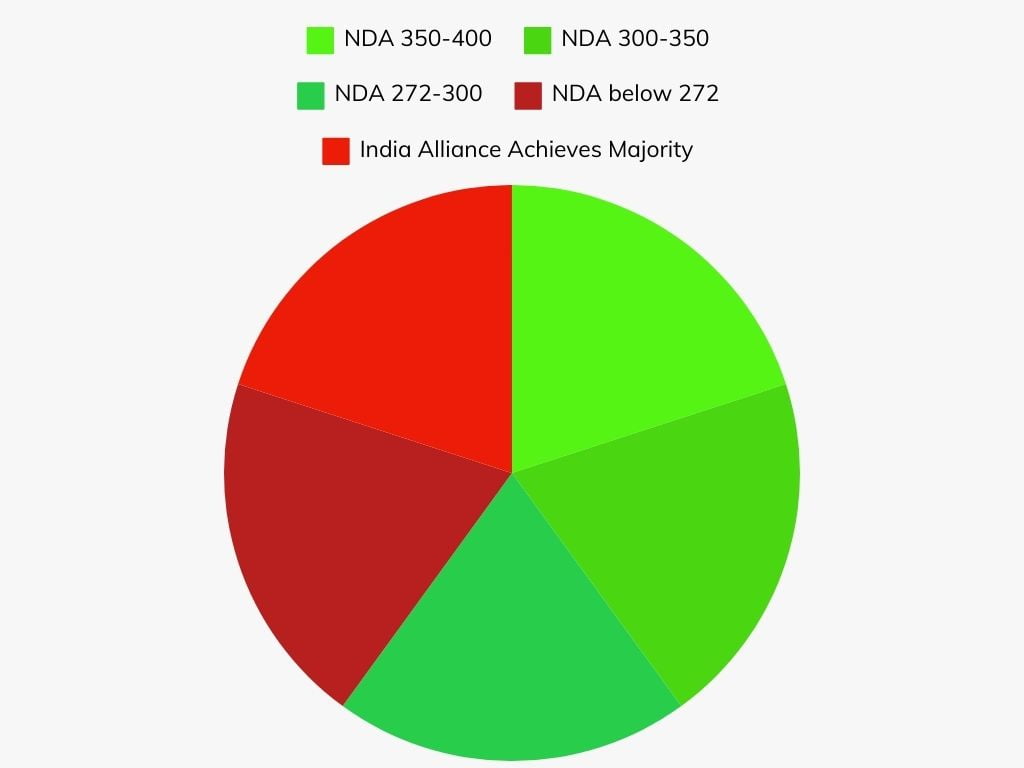

The election results will significantly influence market sentiment, creating various opportunities and risks. Understanding how different scenarios might play out is crucial for effective trading for this mega event.

Whether it’s a decisive victory for the ruling party (BJP+allies) or an unexpected coalition, each scenario can drastically impact stock prices, market volatility, and trading strategies.

Read also: 10 Golden Rules of Stock Market Trading

Here’s a possible practical look at how the market might react under different election outcomes and how traders can position themselves to profit or protect their investments.

1. NDA Wins 350-400 Seats: Super Bullish

If the NDA wins with a strong majority, it will likely boost the PSU and economic sectors. Expect a strong, extended bullish trend in the short to medium term. Investors will feel confident about stable policies and ongoing economic reforms, leading to more buying.

Key sectors like infrastructure, banking, railways, energy, and defense could see big gains because people expect continued government support. The market will celebrate with rising stock prices, showing optimism and renewed investor confidence.

2. NDA Wins 300-350 Seats: Flat to Positive

An absolute majority might already be priced in, leading to a flat or slightly positive market reaction as Nifty and Sensex already hit all-time highs.

However, a fall or profit booking will present a fantastic opportunity to purchase solid stocks.

3. NDA Wins 272-300 Seats: Market Panic

A narrow win creates panic. Expect sharp profit booking and fresh sales, especially in the PSU, economy, and banking sectors. Investors might worry about unclear policies and instability, leading to a lack of confidence in the government’s ability to make reforms.

This could cause heavy selling as traders try to secure profits and avoid losses. Concerns about delays in economic plans and reforms might also make the market less confident. This will result in a wide sell-off in these areas.

4. NDA Wins Below 272 Seats: Market Havoc

The market would collapse when the Narendra Modi-led NDA is defeated, possibly falling by 15% to 30%. A clear mandate under the Narendra Modi-led NDA has been synonymous with stability and growth.

Investor confidence would decline due to their setback, prompting a rush to liquidate long holdings and lock in profits before the market declines even worse.

5. India Alliance Achieves Majority: Bearish

If the India Alliance obtains a majority, the Indian markets may witness severe selling pressure. Market players will be anxious about policy continuity uncertainty.

Possible populist policies could cause investment instability.

The demands of several powerful national-level leaders from different parties might complicate policy-making and spook investors.

Seize the Election Opportunity

The Lok Sabha 2024 elections offer a unique chance to achieve substantial gains by taking calculated risks. Here’s how to make the most of this opportunity:

Leverage Historical Data

Study past elections to identify patterns and potential outcomes. Use historical data to predict market reactions.

Maximize Gains with Leveraged Instruments

Use futures and options to amplify returns. Engage in day trading and swing trading to capitalize on short-term price movements.

Engage in Sensible Trading

Election volatility can lead to significant market swings in the coming days.

Therefore, it will be essential to adopt a prudent trading strategy to safeguard your money and take advantage of possibilities when the market is highly volatile.

Sensible trading means making calculated moves and focusing on risk management to ensure you have enough capital to capitalize on the real action when the election results are announced.

Conclusion

There is a once-in-a-lifetime opportunity to trade in the Lok Sabha election 2024. As a result, one must be well-prepared and create a trading plan that will take volatility into account.

So instead of trying to outsmart your trading skills on June 4, 2024, be ready for different election scenarios and capitalize on this unique opportunity.

Disclaimer: I am not an election analyst or a SEBI-certified stock market analyst. The opinions in this post are based on my personal observations and market research. Readers are solely responsible for their trading and investment decisions, and any gains or losses incurred are their own responsibility. This post is for educational purposes only and is not financial advice. Readers should consult a qualified financial advisor or conduct their own research before making investment decisions.