The stock market is a rollercoaster of ups and downs, but there’s a mysterious term in this financial world known as the “Blue Sky Zone.” Though this concept doesn’t appear in textbooks or technical jargon, it holds a special place in the hearts of investors and traders alike.

In the blue-sky zone, support or downside levels are known, but upside or resistance levels are not. It’s a zone where stocks and indices break all the rules and shoot for the stars. Imagine a place where there are no limits, where the usual barriers that hold stocks back disappear.

In this blog post, I’ll demystify the blue-sky zone. Even though it’s not in typical finance books, it’s a lot like the vast sky, symbolizing endless possibilities. It’s where investors and traders explore uncharted market territory, and I’ll uncover what makes it special.

Where No Resistance Holds

In the blue-sky zone, stocks and indices have climbed so high that they’ve left all the resistance levels in the dust. It’s like they’ve broken free from gravity. Investors here are incredibly optimistic and eager to buy, believing that the only way is up.

As a result, in this situation, we frequently witness a rush of purchasers, either traders or investors. Prices rise quickly and steadily as a result, and this process may continue for a few days to several months. However, it depends on the fundamental health of the underlying asset and the liquidity flow.

What makes it happen?

The blue sky zone isn’t a coincidence; a few important factors make it happen:

- A Thriving Economy: When the economy is booming, the GDP is high, and people are satisfied with their financial situations, it can create the perfect setting for the blue-sky zone in the share market. Money pours into the market from all directions.

- Record-Breaking Market Highs: This zone usually appears when the stock market hits new all-time highs. Think of it as the market flexing its muscles and showing off its strength. This attracts a lot of attention from investors.

Some Chart Patterns for Blue Sky Zone in the Share Market

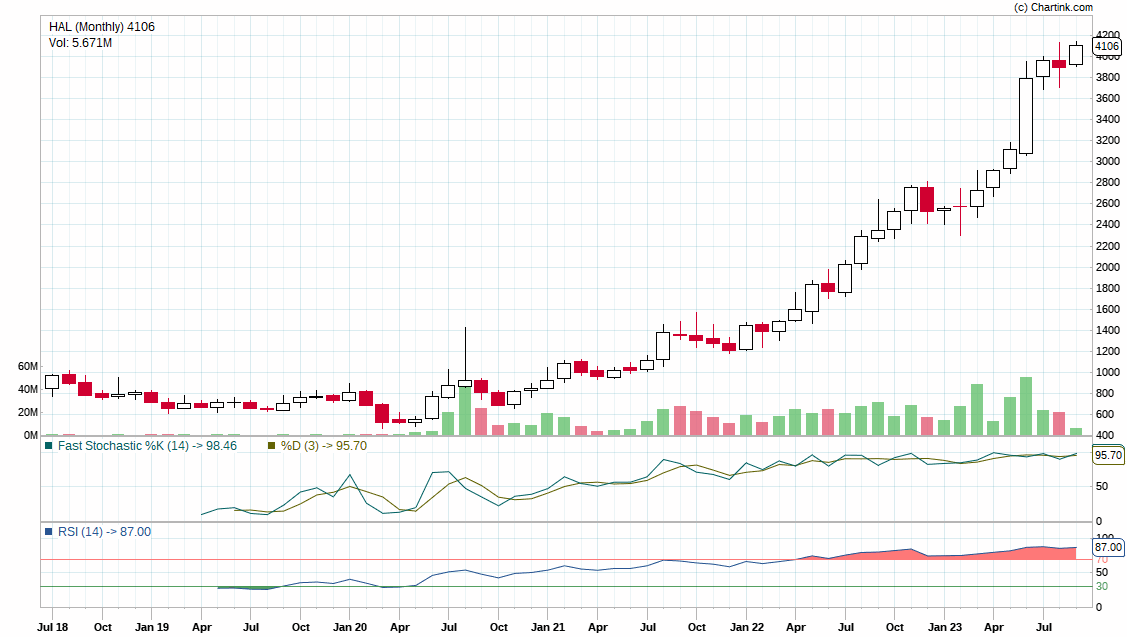

I’ve provided a few illustrations of what are known as blue sky zones on charts. When the following chart patterns appear, where there are no upside barriers and a significant level of buying participation, you can see smooth one-way rises.

By chasing such patterns at the correct time with confidence and courage, one can achieve golden profits. But profit protection and proper money management are always important when you chase these dream rallies.

Strong Uptrend with Higher Highs and Higher Lows

Long-Consolidation Range Breakout

Breakout of Previous Resistance

The Risks of Soaring High

As exciting as the blue-sky area is, it’s not all smooth sailing. You should also be aware of the following risks:

Wild Ups and Downs: In this zone, prices can shoot up like a rocket, but they can also crash down just as fast. So, while there’s potential for big gains, there’s also the possibility of big losses.

Following the Crowd: When everyone’s excited about the Blue Sky Zone, it can lead to something called a herd mentality. People rush in without thinking, which can make the market even crazier and more unpredictable.

Playing It Safe: To navigate this zone safely, investors should be cautious. Use tools like stop-loss orders to limit potential losses, and don’t forget to diversify your investments to spread the risk.

What to Do in Blue Sky Zone

The blue-sky area is like the stock market’s wild side. So, most of the time, stocks and indices reach their highest peaks. But there are risks involved as well, so it’s not all a piece of cake. Seasoned traders and investors understand that the real potential for substantial gains lies within the blue-sky zone.

The primary focus for traders and investors is to ride for big profits in this area with trailing stop losses. They never try to focus on small profits. Because of the blue-sky area, many new investors and fund houses show interest in buying. Consequently, the underlying asset gets boosted to new highs with renewed volume-based participation.

In this circumstance, traits like patience and the willingness to enjoy the ride will pay off. It’s the kind of patience that, although it may take years of waiting, eventually pays off handsomely in an incredibly short amount of time.

However, investors and traders should prepare for sudden ups and downs with high volatility. They must avoid getting caught up in the excitement. So, proper trading psychology and winning mindsets work greatly when this kind of condition arises.

The Bottom Line

Despite the absence of a formal definition, its heart lies in how immense and limitless it feels. It’s like looking up at the endless sky and realizing there are no boundaries. Understanding the patterns and emotions in this zone can be a big help for regular folks who invest and trade in the unpredictable parts of the market. And if you’re willing to dream big and take some risks, some great rewards are waiting for you up there.