Stock Market Today, September 8, 2023: With the Sensex extending its surge for the sixth straight day, the Indian stock market maintained its winning streak on Friday. The Sensex concluded the day 333 points higher, and the Nifty managed to close above the 19,800 level after August 20.

This outstanding performance was fueled by a number of elements, including the surge in energy stocks and good performances by PSU stocks.

Market Movement of the Day

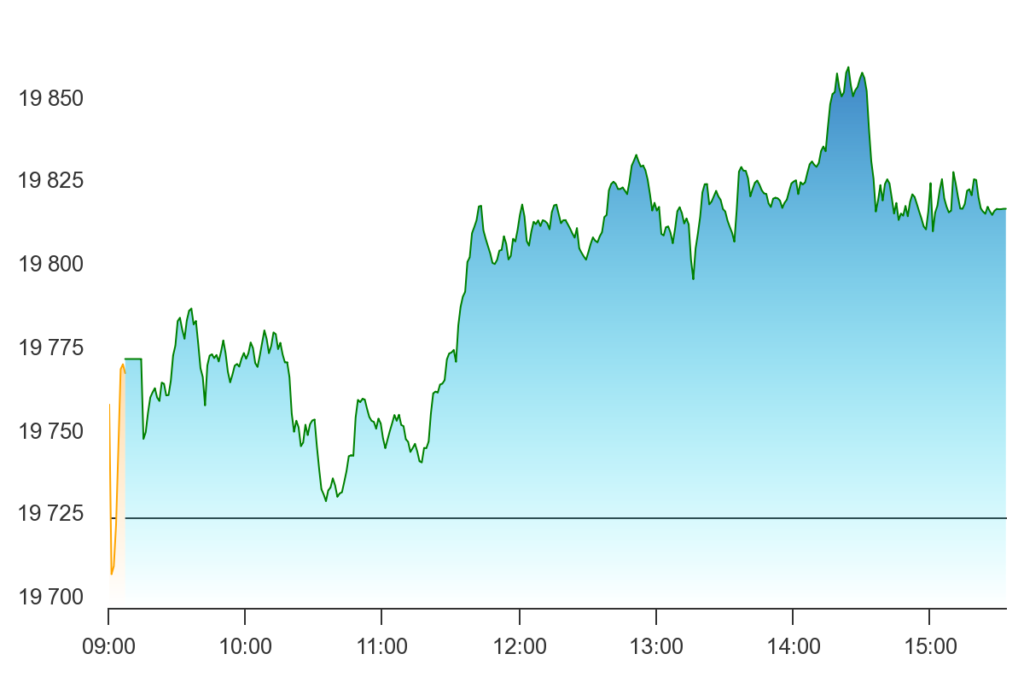

On Friday, the Indian stock market continued to go up for the sixth day in a row. The rally was broad-based today, and indices kept on moving throughout the day. Traders and investors tried to lock in their gains ahead of the weekend. So, towards the end of the day, there was some profit-booking.

For the day, the BSE Sensex went up by 333.35 points, which is 0.50%. It ended at 66,598.91. The Nifty50 went up by 92.90 points, or 0.47%, and closed at 19,819.95. The Nifty Bank also gained 278.05 points and closed above the significant level of 45000. The closing price of Bank Nifty was 45,156.40.

The midcap stocks and smallcap stocks also surged today. The midcap index rose about 1%, and the smallcap index was up by half a percent. The India VIX declined by about 1% to 10.78.

Top 10 Gainers in the F&O (Futures and Options) Segment Today

| SYMBOL | LTP | %CHNG | OPEN | HIGH | LOW | PREV. CLOSE | 52W H | 52W L |

|---|---|---|---|---|---|---|---|---|

| PFC | 306.40 | 12.71 | 273.25 | 306.90 | 271.00 | 271.85 | 306.90 | 100.85 |

| RECLTD | 269.90 | 9.92 | 246.40 | 272.80 | 244.40 | 245.55 | 272.80 | 91.05 |

| HAVELLS | 1,452.00 | 5.95 | 1,376.40 | 1,454.00 | 1,376.00 | 1,370.40 | 1,454.00 | 1,024.50 |

| BHEL | 144.80 | 5.16 | 138.60 | 146.40 | 138.60 | 137.70 | 146.40 | 54.75 |

| CHOLAFIN | 1,183.00 | 4.76 | 1,132.00 | 1,186.70 | 1,132.00 | 1,129.25 | 1,214.60 | 658.00 |

| SHRIRAMFIN | 1,955.00 | 3.24 | 1,910.00 | 1,959.95 | 1,902.80 | 1,893.70 | 1,959.95 | 1,146.00 |

| OBEROIRLTY | 1,187.50 | 2.87 | 1,155.00 | 1,187.50 | 1,154.40 | 1,154.40 | 1,187.50 | 790.10 |

| IEX | 141.85 | 2.79 | 138.80 | 143.40 | 138.10 | 138.00 | 165.45 | 116.00 |

| NTPC | 240.50 | 2.73 | 236.00 | 243.60 | 235.00 | 234.10 | 243.60 | 155.00 |

| CONCOR | 709.60 | 2.70 | 692.00 | 719.35 | 688.55 | 690.95 | 828.75 | 555.00 |

Strong Economic Data Boosts Confidence

One of the key drivers of the market’s robust performance was the release of India’s first-quarter GDP data, which showed growth at an impressive 7.8%, the fastest in a year. So, this positive economic data provided a much-needed boost to investor confidence. As a result, the Indian stock market has been exhibiting the strength and

Safe Haven Amidst Global Uncertainty

Amidst global uncertainties and geopolitical tensions, India emerged as a “safe haven” for investors. The Indian market has garnered fresh interest from both domestic and international investors, seeking stability and growth prospects. This growing interest from investors has been a big reason why the Indian stock market has been doing exceptionally well this year.

Record Run in Small and Mid-Cap Stocks

Small and mid-sized company stocks have been the stars of the stock market this year, far outperforming the big, well-established companies. Small-cap stocks have gone up by 32%, and mid-cap stocks have increased by 29%. In contrast, the larger, more stable blue-chip stocks have only gained 9%. This shows that more investors are willing to take on higher-risk, higher-reward investments in the market.

Energy and Public Sector Enterprises Lead Gains

Among the sectors that stood out, energy companies and public sector enterprises were the top gainers. Energy stocks rose by 0.6%, while public sector enterprises posted impressive gains of 1.3%. The sudden surge in power demand within the country contributed to the rally in power stocks.

Individual stocks like REC and PFC stole the complete show of the market today. Both surged over 10 percent each today where PFC soured around 13% and emerged as top F&O gainer.

India witnessed enormous demand for power due to record-breaking hit waves. Investors swarmed to grab those high-demanding power stocks at any rate. So power stocks have continued their meteoric move.

In addition to the share prices of REC and PFC, NTPC, COALINDIA, and BHEL all kept up their miraculous rallies.

Unaffected By Global Uncertainty

The Indian stock market remained unaffected despite signs of global turmoil, such as a decline in technology stocks in the United States and worries about rising gas prices as a result of strikes in Australia. The continuous surge demonstrated the Indian market’s resilience. With a preference for mid-and small-cap stocks showing the upbeat mood of investors.

Bottom Line

The strength of the Indian stock market demonstrates that it is a suitable spot for investors. Strong economic data, increased investor confidence, and an appetite for riskier assets have all contributed to the recent market rally. Despite ongoing concerns across the globe, India’s stock market still shines as a sign of stability and potential growth.

Investors therefore anticipate more catch-up rallies in the regions where there is still room for a gain in stock prices during the coming week. Now, according to experts, the Indian share market will reach record levels. The benchmark indices are likely to reach fresh highs the following week.