As the 2024 Lok Sabha exit polls hint at a resounding victory for the NDA, anxiety among option buyers has reached a fever pitch. The notoriously costly index options are especially unsettling for traders, who now face the dual threats of high volatility and potentially stagnant market movements.

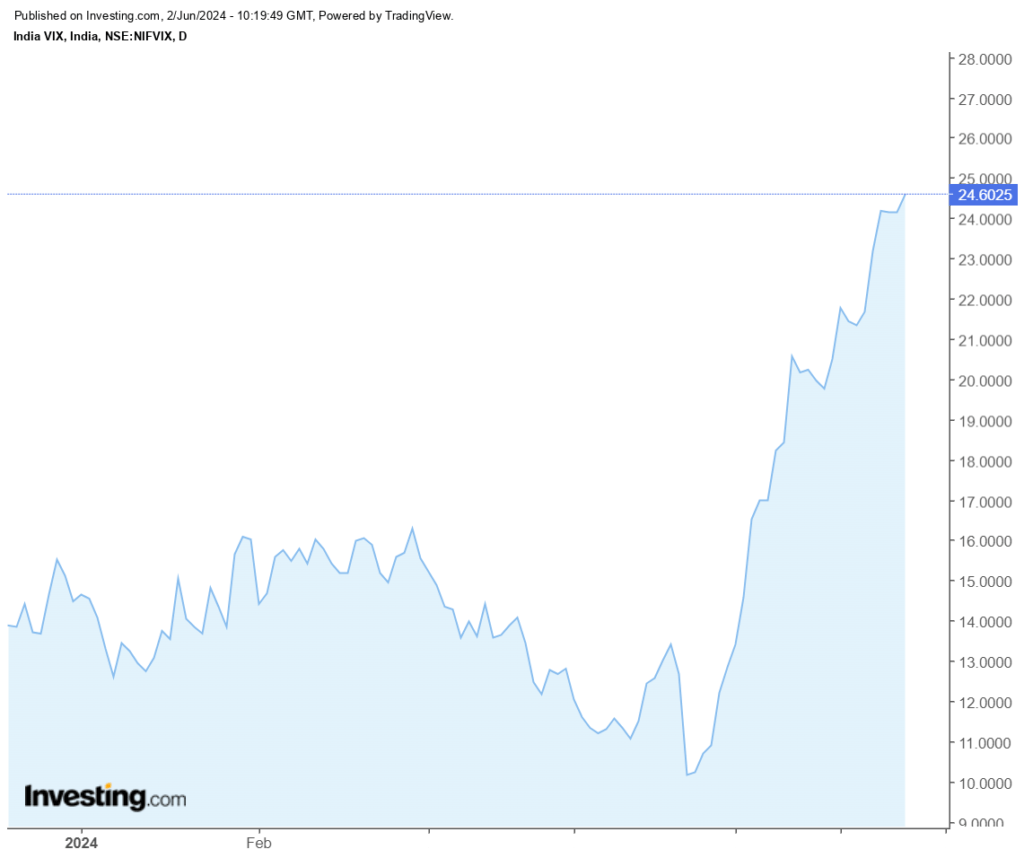

The next two days are crucial, with the India VIX (Volatility Index) soaring. Will option buyers make money, or will they see their premiums evaporate?

Here are the top 11 reasons for fear among option buyers, followed by practical strategies to navigate this uncertain period.

- 11 Reasons for Concern of Option Buyers

- 1. Elevated Volatility Index (VIX)

- 2. Expensive Index Options

- 3. Rapid Decay of Time Value

- 4. Unpredictable Market Reactions

- 5. Divergence Between Stock and Index Options

- 6. Potential for a Market Correction

- 7. Fear of Missing Out (FOMO) and Herd Mentality

- 8. Over-leveraging Positions

- 9. Lack of Protective Strategies

- 10. Psychological Stress and Decision Fatigue

- 11. Common Trading Strategies

- Expiry Day of Index

- Analysis and Prediction for NIFTY Options

- Protective Trading Strategies Post-Election Results

- Conclusion

11 Reasons for Concern of Option Buyers

The costly index options, particularly those tied to the Nifty and Bank Nifty, are especially unsettling for traders. After the exit poll of the Lok Sabha elections, 2024 options buyers now face the dual threats of volatility crashes and potentially stagnant market movements.

Also read: Why Lok Sabha Election 2024 Could Be a Game-Changer for Traders

1. Elevated Volatility Index (VIX)

The VIX, often known as the “fear gauge,” has been exceptionally high ahead of the election results. A high VIX indicates increased market volatility and uncertainty, directly impacting the cost of options. If the NDA wins a resounding majority, the VIX is expected to drop, causing option premiums to plummet. This scenario spells trouble for buyers who need significant market movement to break even or profit.

2. Expensive Index Options

Index options, already pricey, have become even more expensive due to the high VIX. This increased cost can lead to substantial financial losses if the market moves against the position. Given the market’s potential to open flat or slightly positive or negative, buyers may face significant capital erosion immediately following the election results.

3. Rapid Decay of Time Value

As June approaches, the time value of options (theta) decays rapidly. This decay will significantly erode premiums, especially if the market remains stagnant post-election. Option holders may find their investments losing value quickly, leading to potential panic selling and further losses.

4. Unpredictable Market Reactions

Market reactions to exit poll results and eventual election outcomes can be unpredictable. Political events often lead to knee-jerk reactions that are difficult to anticipate. Sudden market swings can catch option buyers off guard, leading to significant losses if positions are not adequately hedged.

5. Divergence Between Stock and Index Options

Unlike index options, which have retained their value, stock options have seen a dramatic 70% decline in premiums over the past week. This divergence can be perplexing and concerning for traders. This can lead to uncertainty and potential missteps in their trading strategies.

6. Potential for a Market Correction

Exit polls can sometimes indicate a market sentiment that leads to over-enthusiasm or pessimism. A market correction could occur if the final results differ significantly from the exit polls. A sharp market correction can devastate option holders who are not prepared, leading to substantial financial losses.

7. Fear of Missing Out (FOMO) and Herd Mentality

Traders often experience FOMO, leading them to take risky positions based on the actions of others rather than solid analysis. This herd mentality can result in overcrowded trades, increased volatility, and the likelihood of significant price swings.

8. Over-leveraging Positions

High market volatility and the allure of quick profits may tempt traders to over-leverage their positions, taking on more risk than they can handle. Over-leveraged positions can amplify losses, leading to margin calls and forced liquidations.

9. Lack of Protective Strategies

Many traders may not employ adequate protective strategies, such as stop-loss orders or hedging with other instruments, increasing their vulnerability. Traders can experience significant drawdowns, eroding their capital base without protective measures.

10. Psychological Stress and Decision Fatigue

The psychological toll of high-stress trading environments can lead to decision fatigue, causing traders to make irrational or impulsive decisions. Poor decision-making can exacerbate losses and undermine long-term trading success.

11. Common Trading Strategies

Many traders have anticipated similar outcomes and market reactions. Most traders, especially retail ones, use common strategies ahead of the Lok Sabha results. However, big market makers often act contrary to the majority’s expectations, and the market tends to do the opposite of what the majority believes will happen.

Also read: Why Will the Sensex Rally After the Lok Sabha Election 2024?

Expiry Day of Index

| Index | Expiry Day |

|---|---|

| NIFTY | The final Wednesday of the expiration period, unless it falls on a trading holiday, in which case the expiration day is the trading day prior. |

| BANKNIFTY | The final Wednesday of the expiration period, unless it falls on a trade holiday, in which case the expiration day is the trading day prior. |

| FINNIFTY | Last Tuesday of the expiry period |

| MIDCPNIFTY | Last Monday of the expiry period |

| NIFTYNEXT50 | Last Friday of the expiry period |

Also read: Futures and Options Trading: Learn To Make Unlimited Gain

Analysis and Prediction for NIFTY Options

Given the high premiums with high Vix and the current NIFTY level, let’s analyze potential targets for a 50–100% profit for option buyers:

I’m considering a scenario where someone is doing a straddle with 22500 CE and 22500 PE, and the NIFTY spot price is 22,530.70. When will the option buyers make a profit?

I’m trying to give a rough idea below!

Current Call and Put Option Premiums

- 22500 Call Option Premium: 482.00

- 22500 Put Option Premium: 372.00

Target for 50–100% Profit

- Call Option: NIFTY needs to move to at least 23,464.00 (22,500 + (482 * 2))

- Put Option: NIFTY needs to drop to at least 21,756.00 (22,500 – (372 * 2))

Evaluate Potential Outcomes

The profit/loss of a straddle strategy depends on the extent of the price movement. Significant movements in either direction will result in profit, while small movements may lead to a loss equal to the total premium paid.

Breakeven Points:

- Upper Break-even: Strike Price + Total Premium = 22500 + 482= 22982

- Lower Breakeven: Strike Price – Total Premium = 22500 – 372 = 22128

Profit Scenarios:

- If Nifty rises significantly:

- The call option will increase in value.

- The put option will lose value, but the gain on the call should offset this.

- Example: If the Nifty rises to 23300 or higher, you start making a profit.

- If Nifty falls significantly:

- The put option will increase in value.

- The call option will lose value, but the gain on the put should offset this.

- Example: If Nifty falls to 21700 or lower, you start making a profit.

To generate a profit from buying options, the Nifty index needs to move at least 4% up or down from where it is now in the next four days. If it moves more than 4%, you could make a big profit, especially if you close any losing trades quickly.

Also read: 10 Golden Rules of Trading Options: Dos and Don’ts

Protective Trading Strategies Post-Election Results

To navigate the post-election results period successfully, traders need to adopt both theoretical and practical strategies:

Staying Agile with Market Sentiment

Monitor market sentiment and adjust your strategies accordingly. Tools like the VIX can help gauge market fear and complacency.

Being Prepared for Unexpected Results

Always have a contingency plan for unexpected results that can impact the market. Being prepared ensures you can react swiftly and effectively.

Maintaining Calm

Stay composed and make rational trading decisions. Meditation, regular exercise, and adequate sleep are vital for maintaining clarity.

Leveraging Expert Guidance

Consult with financial advisors or experienced traders to guide your strategies. Professional advice can provide valuable insights and help you navigate complex market conditions.

Maintain Adequate Liquidity

Ensure you have enough liquidity to cover potential losses and avoid margin calls. Maintaining adequate cash reserves helps you stay flexible during market fluctuations.

Monitoring Market Trends and News

Keep abreast of market news and updates to make timely and informed decisions. Understanding market trends helps you anticipate changes and adjust your strategies accordingly.

Staying Committed to Your Trading Plan

Avoid making impulsive decisions based on short-term market movements. Stick to your long-term trading plan and focus on achieving your financial goals.

Hedge Your Bets

Use financial instruments, like options, to offset potential losses. Techniques such as straddles and strangles can help protect your positions during volatile periods.

Setting Optimal Stop-Loss Levels

Stop-loss orders are essential for protecting your capital. Setting these orders at optimal levels ensures that your positions are automatically sold when they reach a certain price, minimizing potential losses.

Also read: What is the role of a circuit breaker in the stock market?

Conclusion

The 2024 Lok Sabha exit polls have created a high-stakes environment for option buyers. The next two days will be critical, with VIX at elevated levels and premiums soaring. Understanding the reasons for concern and adopting protective strategies can help traders navigate this volatile period successfully.

Remember, the market will always be there, even after major events like the Lok Sabha elections. Keeping your capital safe and playing for long-term goals should be a priority.