Nifty and Bank Nifty Predictions for tomorrow, April 27, 2023: Today, Nifty (17,813.60) and Bank Nifty (42,829.90) ended the day at the high point of the day after the initial dip due to the wobble in US stocks on April 25th. Indian benchmark indices, the Sensex and Nifty, closed above 60300 and 17800, respectively.

US stock futures traded higher since the morning today, which aided some confidence in buyers ahead of the April month expiry on Thursday, April 27th. The Bank Nifty also closed above 42800, thanks to the PSU bank index, which was up by 0.52%.

The broader market also closed in positive territory, though no serious buying has been witnessed for the last few sessions. The Nifty midcap and Nifty small-cap indices closed the day up 0.15% and 0.46%, respectively. We saw positive movements in selected counters only, which was not sufficient to bring back investors’ sentiment strongly.

Today, auto, real estate, FMCG, and PSU bank indexes led the rally of the Sensex and Nifty. The Nifty real estate index was the top gainer, up by 1.36%.

Nifty and Bank Nifty Movement of the Day

| Index Value | Change | Percentage Change | Open | High | Low |

| 17,769.25 | 44.35 | 0.25% | 17,767.30 | 17,827.75 | 17,711.20 |

| 42,829.90 | 151.40 | 0.35% | 42,559.05 | 42,875.60 | 42,432.25 |

Nifty and Bank Nifty reacted negatively to the US markets in the morning today. US stocks brought some volatility in the first half of today, but the underlying strength of the Indian equity market restricted the fall. Nifty and Bank Nifty made lows of 17711.20 and 42432.25 during the first half of the day. But gradually, the Indian market moved higher, erasing the initial losses quite smartly. Though the India VIX (Volatility Index of India) was also moving up throughout the day, on the index front, we didn’t see any kind of weakness.

The Nifty and Banknifty finally closed above the previous congested zones of 17800 and 42800, respectively. The Nifty and Bank Nifty made highs of 17827.75 and 42875.60, respectively. Now, traders and investors are cautious about the April F&O expiry, which will end on the 27th of April. So, experts are anticipating a highly volatile session tomorrow due to the existing f&o positions.

Top Nifty 50 Gainers of the Day

| Company Name | Current Price | Change | Change (%) |

|---|---|---|---|

| Power Grid Corporation of India | 238.3 | 5.40 | 2.32% |

| Nestle India Ltd | 21,026.25 | 361.05 | 1.75% |

| Tata Consumer Products Ltd | 746.7 | 12.25 | 1.67% |

| IndusInd Bank Ltd | 1,137.8 | 16.05 | 1.43% |

| Larsen & Toubro Ltd | 2,276.15 | 28.20 | 1.25% |

| HCL Technologies Ltd | 1,065.55 | 12.10 | 1.15% |

| SBI Life Insurance Company Ltd | 1,118.3 | 12.45 | 1.13% |

| Axis Bank Ltd | 887.65 | 9.30 | 1.06% |

| Tata Motors Ltd | 478.2 | 4.65 | 0.98% |

| Eicher Motors Ltd | 3,248.35 | 30.40 | 0.94% |

Top Nifty Bank Gainers of the Day

| Company Name | Current Price | Change | Change (%) |

|---|---|---|---|

| IndusInd Bank Ltd | 1,137.80 | 16.05 | 1.43% |

| Federal Bank Ltd | 135.00 | 1.60 | 1.20% |

| Axis Bank Ltd | 887.65 | 9.30 | 1.06% |

| Punjab National Bank | 50.25 | 0.45 | 0.90% |

| State Bank of India | 566.35 | 4.55 | 0.81% |

| HDFC Bank Ltd | 1,671.80 | 7.65 | 0.46% |

| IDFC First Bank Ltd | 58.90 | 0.25 | 0.43% |

| Bandhan Bank Ltd | 223.80 | 0.40 | 0.18% |

| ICICI Bank Ltd | 914.95 | 1.50 | 0.16% |

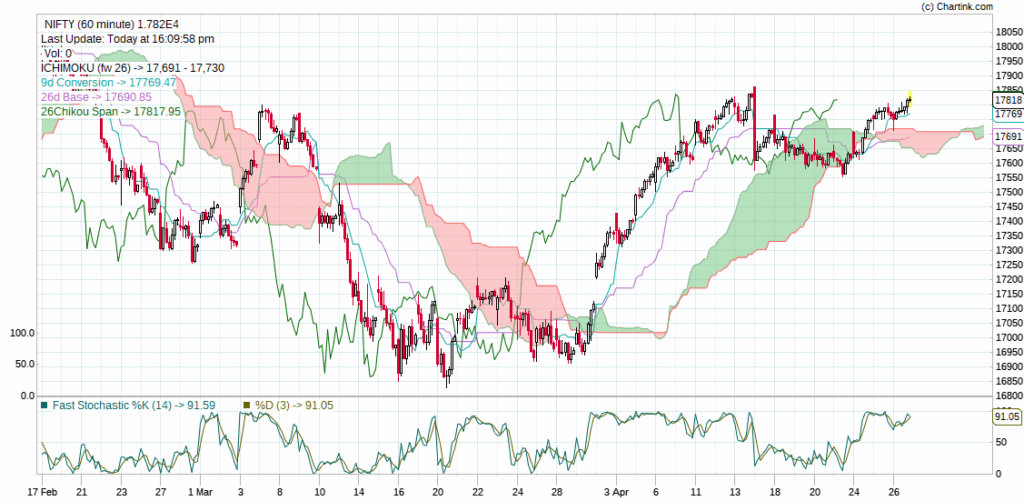

Nifty prediction for tomorrow 27 April 2023

The Nifty 50 closing price of today is above 17800, which is a positive outlook ahead of the April F&O expiry tomorrow. The chart setup for Nifty suggests a bullish momentum continuation pattern as long as it trades above 17780. A sustained decline below this level will probably have a negative outlook for tomorrow.

As of now, to trigger a bout of fresh buying activity, the Nifty has to break and sustain above the previous high of 17863. A breakout above that level will open doors to the psychological level of 18000 tomorrow. On the downside, 17750-17740 will be a zone of support. Breaking this level will intensify supply to levels 17660-17600 again.

Nifty Upside and Downside Levels for Tomorrow 26 April 2023

| Nifty Upside Levels | ||

| 17860 | 17930 | 18000 |

| Nifty Downside Levels | ||

| 17730 | 17670 | 17610 |

Bank Nifty prediction for tomorrow 27 April 2023

In contrast to Nifty, Bank Nifty indicated its upward trajectory would begin a few sessions earlier. On its charts, Bank Nifty’s high momentum and underlying strength are easily apparent. On multiple charts, a trend setup is clear in preparation for tomorrow’s breakout over the psychological milestone of 43000. The trend will be positive and strong until the Bank Nifty breaks below 42700. The resistance will only be close to 43,000 right now.

The strong demand range of 42400-42100 will be reachable below the level of 42700. There must be some bad news in order to break the level’s lower band. Otherwise, the outlook is positive for tomorrow, although it is advised to book profits tomorrow in zones 43100 and 43200.

Nifty Bank Upside and Downside Levels for Tomorrow 27 April 2023

| Banknifty Upside Levels | ||

| 43000 | 43160 | 43400 |

| Banknifty Downside Levels | ||

| 42550 | 42400 | 42150 |

Nifty and Bank Nifty Options Chain Data for Tomorrow

The highest open interest for the Nifty is at 18000 CE and 17700 PE. Looking at the option activities, it’s quite visible that expiry will be above 17700 unless any negative news triggers the market. Equally, Nifty will face strong resistance above 17900. As per the options data, the Nifty range will be 17700-17950.

The highest open interest for the Bank Nifty is @43000CE and 42500PE. There are huge amounts of put writing visible in the Bank Nifty for tomorrow. Though Banknifty will face resistance at 43000 as per the options data, any short covering will easily break the barrier, also having a lower amount of call writing. It means the possible range will be 42500-43200 considering the probability of the breakout above 43000.

Note: Option data can’t alone provide the right trading ideas

Global Market Updates for Tomorrow

On Wednesday, the Asian stock markets exhibited a mixed performance as investors remained concerned about the global banking sector’s health and the possibility of a US recession. The banking sector’s anxiety resurfaced after the US First Republic Bank suffered a massive 49% drop on Tuesday. First Republic Bank lost a lot of money. They had over $100 billion less in deposits in the first quarter of the year. This made people worried that the bank might fail like Silicon Valley Bank and Signature Bank did.

Even though things looked better, people still need to be careful because there are still problems like rising prices and interest rates that could make things worse.

The Hang Seng index, on the other hand, concluded on a positive note due to the surge in tech shares after Microsoft and Alphabet announced their robust quarterly results on Tuesday. The Nikkei in Japan, however, experienced a decline, following the negative cues from Wall Street and caution ahead of the BoJ’s policy meeting on Friday.

The Shanghai index in China slightly fell on Wednesday as investors exercised caution before the upcoming May Day “Golden Week” holiday. Persistent geopolitical tensions also weighed on investor sentiment.

European market indexes are currently trading lower, taking cues from the downbeat session on Wall Street after First Republic Bank’s report of a 40% drop in deposits in the first quarter. The US futures indexes, namely, the Dow and Nasdaq futures, are presently trading higher as of 7.30 p.m. IST.

| Market | Closing Price | Change | % Change |

|---|---|---|---|

| Hang Seng Index | 19,757.27 | +139.39 | +0.71% |

| KOSPI | 2,484.83 | -4.19 | -0.17% |

| Nikkei 225 | 28,416.47 | -203.60 | -0.71% |

| Taiwan Capitalization Weighted Stock | 15,374.63 | +3.90 | +0.025% |

| SSE Composite Index | 3,264.10 | -0.77 | -0.024% |

Conclusion

Experts predict a highly volatile trading session tomorrow due to the April F&O expiration. However, today’s closing price of Nifty and Bank Nifty suggests a positive outlook, and the chart patterns indicate a bullish momentum continuation as long as they remain above the specific levels. Global market updates for tomorrow are mixed, with investor concerns about the health of the global banking sector and the possibility of a US recession.

Please note that all levels discussed above, including those for Nifty and Banknifty, are spot prices.

Chart Credit: Chartink

Disclaimer: To learn additional information about the disclaimer, please refer to the “Disclaimer Page.”