Indian Stock Market Prediction for Next Week (4–8): The start of December marked a remarkable month for the Indian stock market. Positive economic data and an upbeat investor mood propelled key indexes to a strong rise last week.

Now, after the state election result, the Indian stock market is poised for a strong rally this week.

Market Performance Last Week

On December 1, the Nifty 50 index closed with a gain of 135 points, reaching 20,267.90, while the Sensex recorded a substantial rise of 493 points, closing at 67,481.19.

The Nifty 50 reached a new life high of 20,291.55. The strong rally was due to broad-based buying interest and better-than-expected Q2 GDP numbers for India.

Record-breaking Mid- and Small-Cap Indices

The positive momentum extended to mid- and small-cap segments, with the Nifty Midcap 100 index reaching a peak of 43,469.30 and closing 1.10% higher at 43,382.40.

Simultaneously, the Nifty Smallcap 100 index scaled a new height of 14,305.10, closing 0.48% higher at 14,239.30. These milestones underscored the broad-based nature of the market rally.

Indices Beyond Nifty and Sensex

The enthusiasm wasn’t confined to the Nifty and Sensex alone. Other indices, including BSE Midcap and BSE Smallcap, also witnessed gains.

The BSE Midcap index closed 0.96% higher at 34,586.76 after reaching a new record high of 34,631.35. The BSE Smallcap index ended with a gain of 0.48% at 40,565.96 after hitting its record high of 40,718.81 during the session.

Factors Driving Market Enthusiasm

- Strong GDP numbers:

- India’s Q2 GDP growth of 7.6% surpassed expectations, signaling robust domestic demand and fostering a positive growth outlook for the market.

- Political stability expectations:

- Exit polls from state elections indicated political stability, calming the market and strengthening the belief that the BJP is well-positioned for the 2024 general elections.

- Role of Retail Investors:

- The domestic market experienced a surge in retail investors, with over 3 crore registered investors at BSE, providing crucial support during periods of foreign investor divestment.

- Hopes of No More Rate Hikes:

- Anticipation of a peak in US interest rates, potentially leading to rate cuts around May or June next year, contributed to the renewed interest of foreign portfolio investors in the Indian market.

- Technical Factors:

- The short-term technical outlook for Nifty favored bulls, with support seen at 20,150–19,950 and resistance at 20,500–20,700. Positive sentiment and a bullish crossover in the weekly RSI and stochastics indicated the potential for further upward movement.

Indian Stock Market Prediction for Next Week (4–8)

Nifty 50 pivot levels for next week:

| S3 | S2 | S1 | Pivot | R1 | R2 | R3 |

|---|---|---|---|---|---|---|

| 19,456.47 | 19,628.23 | 19,948.07 | 20,119.83 | 20,439.67 | 20,611.43 | 20,931.27 |

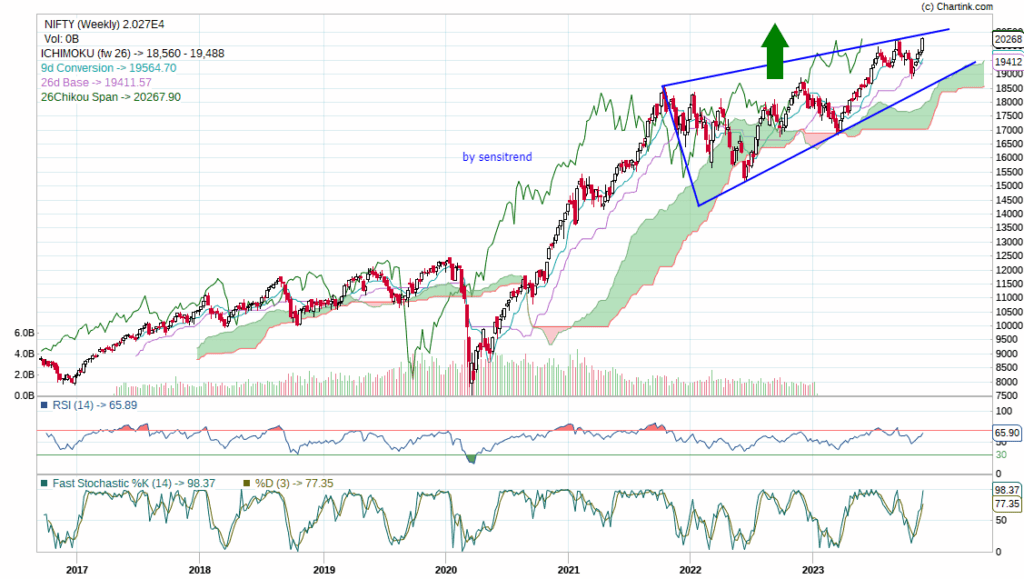

Nifty Prediction For Next Week 4-8 December

The Nifty 50 has charted a promising trajectory on its weekly chart, characterized by consistently higher highs and higher lows. The breakthrough of its previous all-time high on December 1, reaching a fresh peak at 20,291.55, has sparked anticipation.

The chart suggests a potential upside barrier in the 20,400–20,500 range for this week, with the possibility of Nifty aiming for the 20,500 mark if the current trend persists.

A key confirmation awaits as Nifty Spot’s weekly closing above 20,500 could signify a substantial breakout. It can potentially pave the way for a significant upside beyond 21,000, too.

On the downside, the area 20000–19900 will act as very strong support this week. But the immediate support will be around 20,150–20,100.

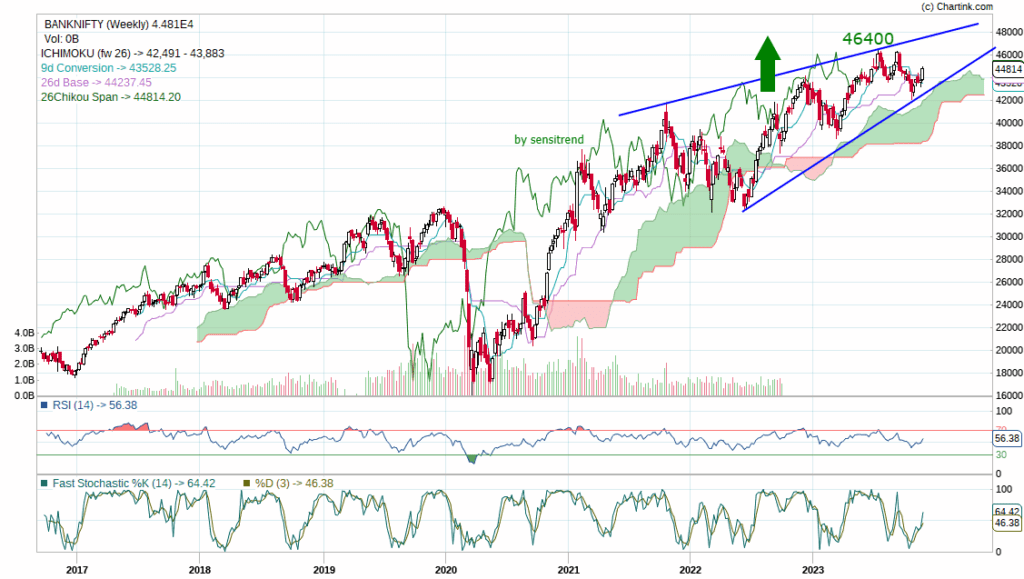

Bank Nifty Prediction For Next Week 4-8 December

On the other hand, Nifty Bank has underperformed Nifty substantially for the last few weeks. But last week’s move in the Bank Nifty reignited its upside potential again. Though Banknifty underperformed, it never broke the lower trendline on a weekly closing basis.

So, both the Nifty 50 and the Bank Nifty were trading within a rising channel.

As per the chart, 46500 will be the channel resistance zone and 43000 will be the support area for this week. Above 45,000, the move will be fast and furious this week. Bank Nifty can hit 45700–46200 this week in a best-case scenario.

On the downside, 44500–44200 will act as a strong support area. As long as the share price of Bank Nifty holds this area, there will be a good chance of an up move beyond 46000.

Bank Nifty pivot levels for next week:

| S3 | S2 | S1 | Pivot | R1 | R2 | R3 |

|---|---|---|---|---|---|---|

| 42,841.00 | 43,290.40 | 44,052.30 | 44,501.70 | 45,263.60 | 45,713.00 | 46,474.90 |

Conclusion

December is starting on a positive note in the Indian stock market. The market was driven last week by the combination of strong economic data and investor optimism.

However, the Indian market may continue its strong upward trend this week following the much-anticipated results of the state elections, in which the ruling BJP party won three of the five states.

When euphoria peaks, traders should proceed cautiously in the market. A very optimistic month lies ahead, despite the possibility of a profit booking on the upside.

Disclaimer: This article is purely educational content based on my own analysis and opinions. I’m not a SEBI-certified research analyst, so before making any trading or investment decisions, please consult with a certified research analyst.

For further inquiries, please visit the Disclaimer page, and for more updates, please visit the Sensitrend home page.