- Introduction

- What is the Banknifty Index?

- Why is Bank Nifty important?

- How does Bank Nifty work?

- How is the Banknifty Index calculated?

- How to Trade in Bank Nifty

- How to Predict the Movement of the Banknifty Index

- Why Do Most Traders Trade in Banknifty

- What is the Expiry of Bank Nifty

- What are the Ways to Make a Position in Banknifty

- Frequently Asked Questions

- Conclusion

Introduction

Have you ever heard of the Banknifty Index? Are you tired of spending countless hours searching for the best trading component in the Indian stock market? Well, I have some exciting news for you! A lot of F&O traders have achieved success by trading only the Bank Nifty index in India. This article is designed to help you join this journey toward financial prosperity.

Don’t waste any more time; let’s unlock your full potential and make your trading dreams a reality!

What is the Banknifty Index?

Banknifty is an index of the National Stock Exchange of India (NSE). Banknifty is not an individual stock; instead, a few large banking stocks in India make up this index. It tracks the performance of the overall banking sector of India. It was introduced on September 15, 2003. Its base year is January 1, 2000, and it started with a base value of 1000. Since then, it has become an essential barometer for the Indian banking sector’s health.

The Bank Nifty Index, or Nifty Bank, is a highly popular stock market index in India. It consists of the 12 most liquid and large-capitalized Indian banking stocks. It’s India’s most active and high-beta stock market index after the Nifty 50. If we consider the number of option contracts traded, it surpasses the Nifty 50 in the derivative segment. So traders from all over the world participate in creating wealth by trading this index.

Bank Nifty tracks the performance of India’s banking sector. It makes it a valuable tool for investors to monitor the industry’s performance. Bank Nifty is a popular index because the banking sector is a crucial component of the Indian economy.

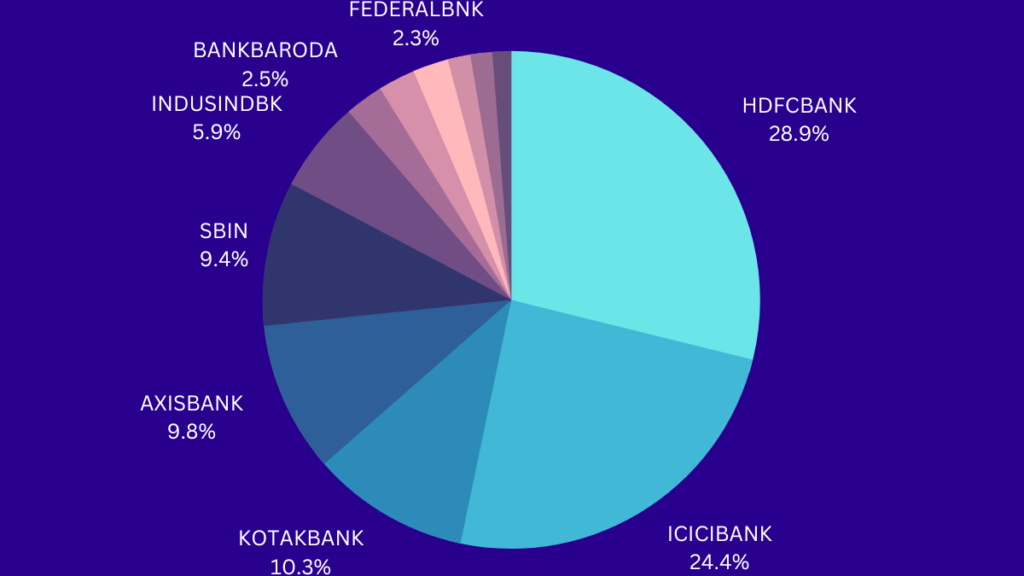

There are 12 main banks listed on Banknifty Index

| BANK NAME | NSE SYMBOL | WEIGHTAGE |

|---|---|---|

| HDFC BANK | HDFCBANK | 28.86% |

| ICICI BANK | ICICIBANK | 24.42% |

| KOTAK BANK | KOTAKBANK | 10.27% |

| AXIS BANK | AXISBANK | 9.79% |

| STATE BANK OF INDIA | SBIN | 9.39% |

| INDUSIND BANK | INDUSINDBK | 5.94% |

| AU BANK | AUBANK | 2.41% |

| FEDERAL BANK | FEDERALBNK | 2.31% |

| BANDHAN BANK | BANDHANBNK | 1.48% |

| IDFC FIRST BANK | IDFCFIRSTB | 1.42% |

| PUNJAB NATIONAL BANK | PNB | 1.22% |

Why is Bank Nifty important?

The Banknifty index is significant for a number of reasons. Global financial institutions and domestic mutual funds use the Bank Nifty index as a benchmark to measure the performance of the banking sector in India. Not to forget that banks are significant contributors to the Indian economy.

The Bank Nifty is so liquid that traders and investors can use it to hedge their portfolios or enter leveraged positions. Economists and market participants always closely follow the Bank Nifty.

Any change in it might affect the mood of the market as a whole. Overall, Bank Nifty is a valuable instrument for long-term investors and traders. It always plays a significant role in the Indian stock market.

How does Bank Nifty work?

Bank Nifty works just like any other stock market index. The Bank Nifty reflects the overall performance of the banks included in the index, and the share prices of these banks determine whether their value rises or falls. The top stocks of BankNifty control the movement of the overall index.

The index calculates its value using the free-float market capitalization-weighted methodology. This methodology assigns a higher weight to stocks with a higher market capitalization. The index is available for trading in the derivatives segment of the NSE.

How is the Banknifty Index calculated?

The Nifty Bank Index is a market capitalization-weighted index. It means that the weight of each stock in the index is proportional to its market capitalization. The free-float market capitalization methodology calculates the index by considering only the shares that are available for trading in the market.

The formula for calculating the Bank Nifty index is as follows:

Bank Nifty Index = [(Sum of Free Float Market Capitalization of 12 Stocks) / (Base Market Capitalization)] x (Base Index Value)

How to Trade in Bank Nifty

To trade the Bank Nifty Index, you need to have a basic understanding of the stock market and trading. So, unless and until you become familiar with stock trading you shouldn’t try any index.

Some Basic Things Every Trader Needs to Know

- Know about the market and economic indicators like GDP, inflation, interest rates, and corporate earnings that affect the stock market and the Bank Nifty Index.

- Understand technical analysis, which involves using charts and indicators to predict price movements. You can use tools like moving averages, candlestick patterns, and trend lines to analyze the Bank Nifty Index.

- Fundamental analysis involves analyzing a company’s financial statements, management quality, and industry trends. Knowing about the fundamental analysis can help you make informed decisions about the Bank Nifty Index.

- Risk management is essential in trading as it involves risk. You should understand strategies like stop-loss orders and position sizing to manage your risk effectively.

- You should know about various trading strategies like swing trading, day trading, and position trading, and how they apply to the Bank Nifty Index.

- You should have the required knowledge in futures and options trading before starting trading in the banknifty index.

Practical Approach to Start Trading In Banknifty Index

The Bank Nifty Index is a derivative product of the NSE. Those interested in buying or selling the BankNifty index can only use futures or options contracts.

Each derivative product has a particular lot size, and BankNifty is no different. Buyers or sellers can make positions only according to the lot size of the particular derivative product, whether it’s stock or index.

Why is lot size important in Banknifty

The lot size of Bank Nifty futures and options is 25, which means each contract represents 25 units of the Bank Nifty Index.

Traders use the lot size to calculate the margin requirement, which is a percentage of the contract value. For instance, if the Bank Nifty Index is at 40,000 and you buy one lot of Bank Nifty futures, the contract value would be 10,00,000.

To determine profits or losses, traders can multiply the change in the Bank Nifty Index by 25. For example, if the Bank Nifty Index increases by 100 points and you have bought one lot of Bank Nifty futures. So, your profit would be 2,500, excluding brokerage and other charges.

How to Calculate Premium in Banknifty

When trading Bank Nifty options, the lot size is used to calculate the premium, which is based on the underlying Bank Nifty Index and the lot size of 25.

When you buy an option, you have to pay a cost known as the premium. On the other hand, when you sell an option, you earn a premium.

The cost of the premium depends on the strike price, expiration date, the current value of the Bank Nifty Index, and the volatility of the underlying asset.

A lot size of 25 is utilized to determine the premium of BankNifty. For instance, you would pay a premium based on the difference between the current price and the strike price multiplied by 25 if you were to purchase a call option with a strike price of 40,000 when the Bank Nifty Index is trading at 40,500. (lot size).

We would calculate the premium as follows in this example:

Premium = (40,500 – 40,000) * 25 = 12,500

Hence, to buy a Bank Nifty call option contract with a 25-lot size, you need to pay Rs. 12,500 as a premium. If you sell an option, you can earn the same amount of premium. Traders need to know the lot size because it helps them figure out how much money they need to invest and how much they can make or lose.

How to Predict the Movement of the Banknifty Index

To trade BankNifty, you need to be able to guess what the index will do in the future. But it’s not easy to do this without learning some technical knowledge over time.

Here are some fundamental factors to consider when predicting the direction of Bank Nifty:

Banknifty Live Chart and Trend

When we trade in the stock market, we need to keep an eye on the BankNifty index’s live chart and trend. It tells us if the index is going up or down. We can check the live chart of banknifty on nseindia.com, which is the main website of the NSE. But the charts on the NSE may be delayed by 5 minutes.

We can also use free websites like investing.com, tradingview.com, and chartink.com to study the charts of banknifty and draw lines on charts to see the trend. TradingView live BankNifty chart is a popular choice for many traders due to its user-friendly interface and advanced analytical tools.

For historical data on stocks or indexes such as Nifty and BankNifty, chartink.com provides a straightforward and easy-to-use platform that is ideal for novice traders. By leveraging chartink.com’s simple yet powerful features, traders can conduct thorough research on market trends and historical performance. It enables traders to make winning trading plans and improve the overall trading success ratio.

If the BankNifty is going up, we can try to buy, and if it’s going down, we can try to sell. Knowing the trend is important to make smart trading decisions.

Pivot Points

A pivot point trading strategy is a helpful tool for trading. It’s beneficial for BankNifty and Nifty because it often shows how the market will move during the day. A lot of traders use this strategy, so it usually works well. That’s why the Nifty Bank Index usually follows the pivot points.

If you want to trade using pivot points, you can follow these steps:

- Find the pivot point for the banknifty future or spot you want to trade.

- See if the price of the index is higher or lower than the pivot point.

- If the price is higher than the pivot point, think about buying. If the price is lower than the pivot point, think about selling.

- Look for other vital levels like support and resistance that could help you decide when to take profits or stop loss.

Remember that pivot points are not sufficient alone to look at when trading, and they don’t always mean you will make money. You should look at other things like what’s happening in the market, the news, and other signs before you make a trade.

PCR

PCR stands for Put-Call Ratio. It’s a way to see how many people are buying CALL options and how many people are buying PUT options. The put-call ratio can help traders see if people are feeling positively or negatively about the stock market. If more people are buying put options, it means they think the market will go down (bearish).

If more people are buying call options, it means they think the market will go up (bullish). In an uptrend, if the PCR of BankNifty moves towards 1.5, the index will become overbought. This means that traders are excessively bullish on the market, and the prices may soon reverse. In such a situation, it is best to avoid initiating a long position, as it may lead to losses.

On the other hand, in a downtrend, if the PCR moves toward 0.5, the index will become oversold. This means that traders are excessively bearish on the market, and the prices may soon reverse. In this case, it is best to avoid initiating a short position as it may lead to losses.

Currency Movement

The USD/INR exchange rate can affect the BankNifty index. If the exchange rate of USD/INR goes up, it could mean the Indian rupee is getting weaker, which might make traders more pessimistic about BankNifty. On the other hand, if the USD/INR goes down, it means traders can take a bullish view of the banking stocks.

Movement of top 5 Banks

The top 5 banks in India are HDFC Bank, ICICI Bank, Kotak Mahindra Bank, Axis Bank, and State Bank of India. They are really important for trading BankNifty because their stock prices can affect the BankNifty index a lot. So traders need to watch how well these banks are doing to make good trading choices.

If the stock prices of these banks go up, it could mean that the market is going up, and traders might make bullish decisions that will make them money. But if the stock prices go down, it could mean that the market is going down, and traders might make bearish decisions to try and make money. This means that how well these banks are doing can tell us a lot about how well the Indian banking sector is doing.

News, Events, and Fundamental Analysis

When you trade the Bank Nifty Index, it’s important to understand the market and economic indicators like GDP, inflation, interest rates, and corporate earnings. These indicators can affect the stock market and the Bank Nifty Index, so knowing about them can help you make better trading decisions.

Another important thing to know is fundamental analysis, which involves analyzing a company’s financial statements, management quality, and industry trends. Knowing about the fundamental analysis can help you make better decisions about the Bank Nifty Index by looking at a company’s financial performance and industry trends.

Why Do Most Traders Trade in Banknifty

Bank Nifty is a popular choice for traders in the Indian stock market because it has many advantages. One advantage is that the Bank Nifty is more volatile than other indexes. This can create more opportunities for traders to make money quicker than other derivative instruments.

Another advantage of Bank Nifty is that it is highly liquid. It means that traders can easily buy and sell the index due to the large volume of shares traded during trading hours. This gives traders the flexibility to enter and exit trades quickly.

Bank Nifty also offers diversification because it includes 12 different banking stocks. This can help reduce risk and increase potential returns. The derivatives market for Bank Nifty is also well-developed, which provides traders with the ability to take leveraged positions or hedge their portfolios.

Lastly, the banking sector is an essential part of India’s overall growth. By trading Bank Nifty, traders can play a part in the growth of India.

What is the Expiry of Bank Nifty

BankNifty options are contracts that let traders buy or sell the BankNifty index at a specific price within a set time frame. The expiration date of BankNifty options is very important because it determines when traders can buy or sell the option.

There are two types of expiry for BankNifty options: weekly and monthly. Weekly options usually cost less than monthly ones because they last for a shorter time. But if there’s big news or market events, the premium for weekly options can go up a lot.

Weekly options expire every Thursday after one week, while monthly options expire on the last Thursday of each month.

Monthly options usually cost more because they last longer, giving traders more time to make money from price changes in the underlying asset (NIFTY BANK INDEX SPOT PRICE). Premiums for monthly options can also go up if there’s more uncertainty in the market or big changes in the asset’s price.

When BankNifty options expire, it helps decide the price of the asset, manages risk, and encourages trading. As the expiration date gets closer, traders change their positions based on what they think will happen to the asset’s price.

BankNifty options expire because they’re derivative products of NSE. As the expiry date nears, the option’s value decreases, and if it’s not traded or exercised, it will expire worthless. This makes options different from the underlying asset, and that’s why they’re called derivative products.

What are the Ways to Make a Position in Banknifty

To trade the Bank Nifty, traders can only use futures and options. To trade these, they must have a trading account with a broker that enables the futures and options segments. Futures trading requires more capital and margin than options trading. However, traders tend to lose more money in options trading due to a lack of discipline and proper trading plans. Therefore, it’s important for traders to develop a strategy and stick to it when trading Bank Nifty.

Traders have different ways to make bullish or bearish trades in Bank Nifty. Two of the most widely used methods are buying and selling futures or buying call-and-put options.

How to Make Bullish Trade In Banknifty Index

To make a bullish trade using futures, a trader can buy Bank Nifty futures contracts. This means that the trader agrees to buy Bank Nifty at a predetermined price and time in the future. If the price of Bank Nifty increases by the time the contract expires, the trader can sell the contract for a profit.

Another way to make a bullish trade is by buying call options. A call option gives the trader the right but not the obligation to buy Bank Nifty at a predetermined price (strike price) on or before a specific date (the expiration date).

How to Make Bearish Trade In Banknifty Index

Similarly, a bearish trade using futures involves selling Bank Nifty futures contracts. This means that the trader agrees to sell Bank Nifty at a predetermined price and time in the future. If the price of Bank Nifty decreases by the time the contract expires, the trader can buy back the contract for a profit.

On the other hand, buying put options is a way to make a bearish trade. A put option gives the trader the right but not the obligation to sell Bank Nifty at a predetermined price (the strike price) on or before a specific date (the expiration date).

It’s important to keep in mind that these trading strategies involve risk and require careful analysis and risk management. Traders should have a proper understanding of the market before applying these methods.

Frequently Asked Questions

What is Banknifty Index?

It’s an index of India’s top 12 large-capitalized banks.

What is the number of banks that are included in the Bank Nifty Index?

There are 12 banks included in the Bank Nifty Index.

Why is the Banknifty Index best to trade?

Banknifty Index is best to trade because of its volatility, liquidity, and diversification.

Is it possible to make quick profits in Banknifty Index?

Yes, it’s possible when compared to stocks.

Can Banknifty Index be manipulated like stocks?

No, it’s hardly possible due to the wide participation from the trading communities.

Is Banknifty, index, or stock?

Banknifty is an index.

Conclusion

Banknifty is an index that shows how well the banking industry is doing in India. Investors and traders can use it to keep track of how the sector is performing and find trading opportunities to make big profits. However, before trading, it’s important to do your research and be careful with your decisions. Staying disciplined, learning from your mistakes, starting small, and increasing gradually can all help you succeed in Bank Nifty trading.

Disclaimer: As a trader, it’s important for me to make a disclaimer regarding the article on the Bank Nifty index. I want to emphasize that the information I share is based solely on my personal experiences and knowledge.